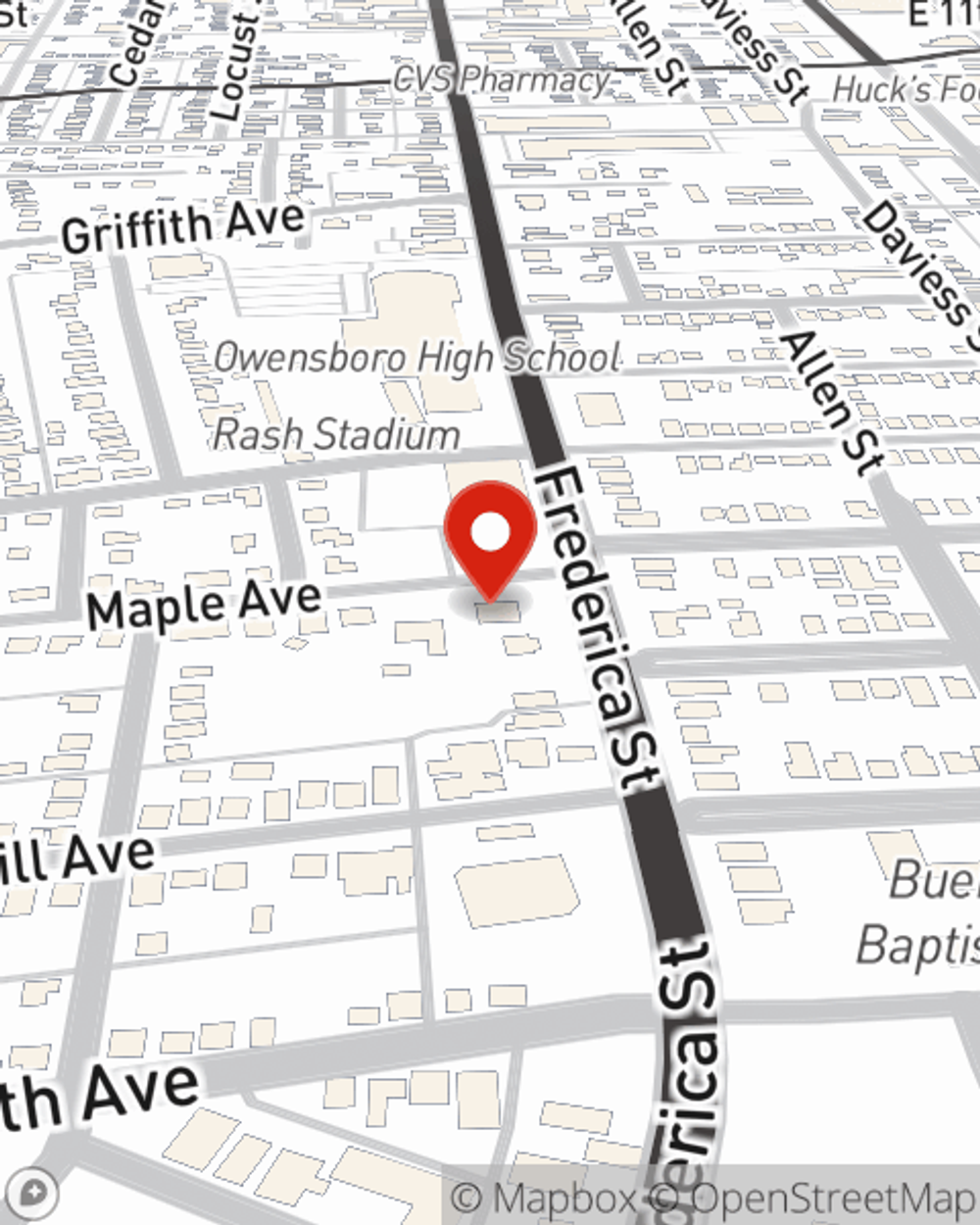

Business Insurance in and around Owensboro

Calling all small business owners of Owensboro!

Insure your business, intentionally

- Philpot

- Utica

- Henderson

- Daviess County

- Ohio County

Coverage With State Farm Can Help Your Small Business.

Whether you own a a hearing aid store, a tailoring service, or a toy store, State Farm has small business insurance that can help. That way, amid all the different options and moving pieces, you can focus on your next steps.

Calling all small business owners of Owensboro!

Insure your business, intentionally

Surprisingly Great Insurance

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for commercial liability umbrella policies, surety and fidelity bonds or builders risk insurance.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Shane Satterfield is here to help you discover your options. Visit today!

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Shane Satterfield

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.